-

Project NameAfrica Sustainable Rice Bond

-

Project Phase2025 to 2030

-

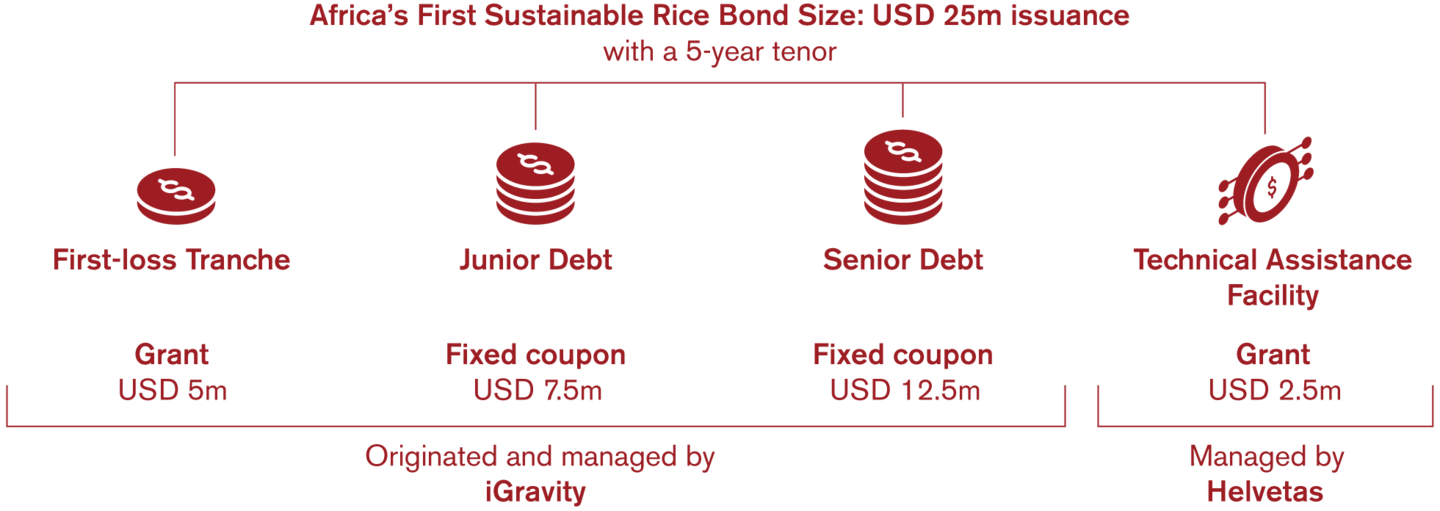

FundingBlended Finance: a combination of grants and investments

-

Thematic focusSkills, Jobs and Income

Water, Food and Climate

Growing demand for rice in Sub-Saharan Africa offers significant potential for inclusive economic development; however, limited access to finance, modern technology and climate-resilient practices continues to hinder local producers from realizing their full economic and environmental potential.

Financing sustainable rice in Sub-Saharan Africa

Demand for rice is rising rapidly in Sub-Saharan Africa, yet over 40% of the rice consumed in the region is imported at an annual cost of USD 5 billion.

With more than 80% of locally produced rice grown by smallholder farmers — 60% of whom are women — limited access to finance, modern tools and climate-resilient practices continues to hold back local production, undermining wages, business growth and environmental outcomes.

Africa’s first Sustainable Rice Bond addresses these challenges by channelling capital and technical expertise across the entire rice value chain through local financial institutions and agricultural intermediaries.

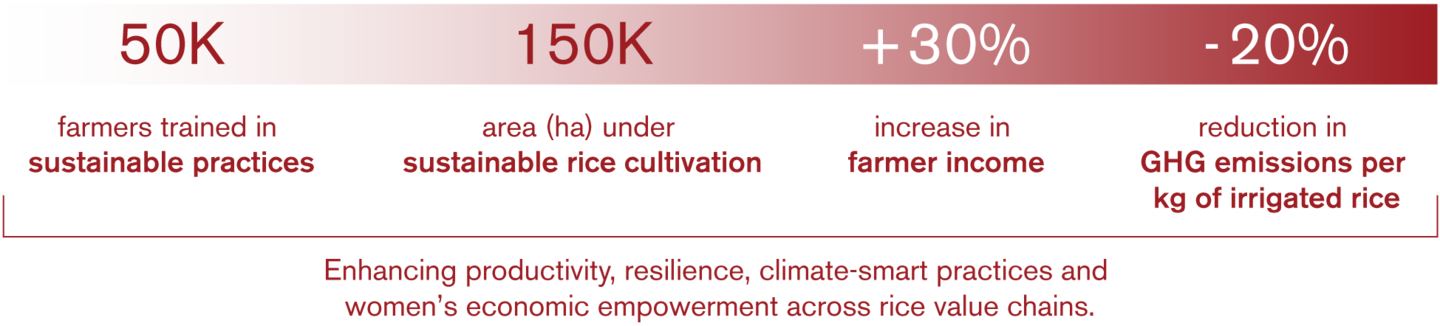

The funding enables farmers to adopt climate-smart and inclusive practices by investing in better inputs, targeted training, improved water management, and post-harvest technologies. As production becomes more sustainable, the initiative also generates measurable climate benefits, including reduced methane and CO₂ emissions.

This will strengthen the local rice sector by increasing incomes for smallholder farmers and other value chain actors.

Investee profiles

The Sustainable Rice Bond will channel investments through local financial institutions and agricultural intermediaries to strengthen rice value chains. See examples of two investee profiles:

Operational setup

Technical assistance coordinator

Helvetas has over 10 years’ experience in sustainable rice projects across Asia and Africa. Through an inclusive systems approach centered on livelihoods, climate resilience and social inclusion, the organization delivers strong social and environmental outcomes, providing the technical expertise that underpins the bond.

Facility manager

iGravity, a Swiss-based advisory and investment firm specialising in impact investing and innovative financing for development, leverages its expertise to structure and manage this blended finance instrument, mobilize capital and de-risk investments to scale climate-smart rice value chains.

Impact

Key financials

Partner with us

Together we will translate this approach into bankable, climate-resilient investments with clear KPIs and strong verification. To kick-start the Africa Sustainable Rice Bond, we are seeking grant funding to capitalize the technical assistance facility and to fund the first-loss tranche. These instruments de-risk the portfolio, crowd in private capital and accelerate delivery.

Partner with us to mobilize capital for measurable impact. Together, we can create the opportunities for African farmers to boost productivity and adopt climate-smart rice production locally.