-

Project NameSocial Enterprise Fund (SEF)

-

Project Phase2024 to 2025

-

FundingCatalytic funding

-

Thematic focusSkills, Jobs and Income

As Helvetas completed the YouLeap project and closed its country programme in Sri Lanka (end of 2025), ensuring the long-term sustainability of its partner social enterprises and support ecosystems remains critical.

Financing social enterprise growth in Sri Lanka

Over the years, the YouLeap program has strengthened Business Incubation Centres (BICs) and supported a diverse portfolio of social enterprises that address youth employment, women’s economic empowerment, climate resilience and rural livelihoods.

As Helvetas transitions out of Sri Lanka, these enterprises face a critical financing gap. While many have reached the acceleration stage, access to appropriate market-based capital and continued technical assistance remains limited, threatening the sustainability of hard-won development gains.

The Social Enterprise Fund responds to this challenge by embedding YouLeap’s achievements into Sri Lanka’s evolving impact investment ecosystem. Promoted by the Lanka Impact Investing Network, with the United Nations Development Programme as the impact monitoring partner, the Social Enterprise Fund provides a blended finance solution designed to unlock long-term growth opportunities for impact-driven small and medium-sized enterprises (SMEs).

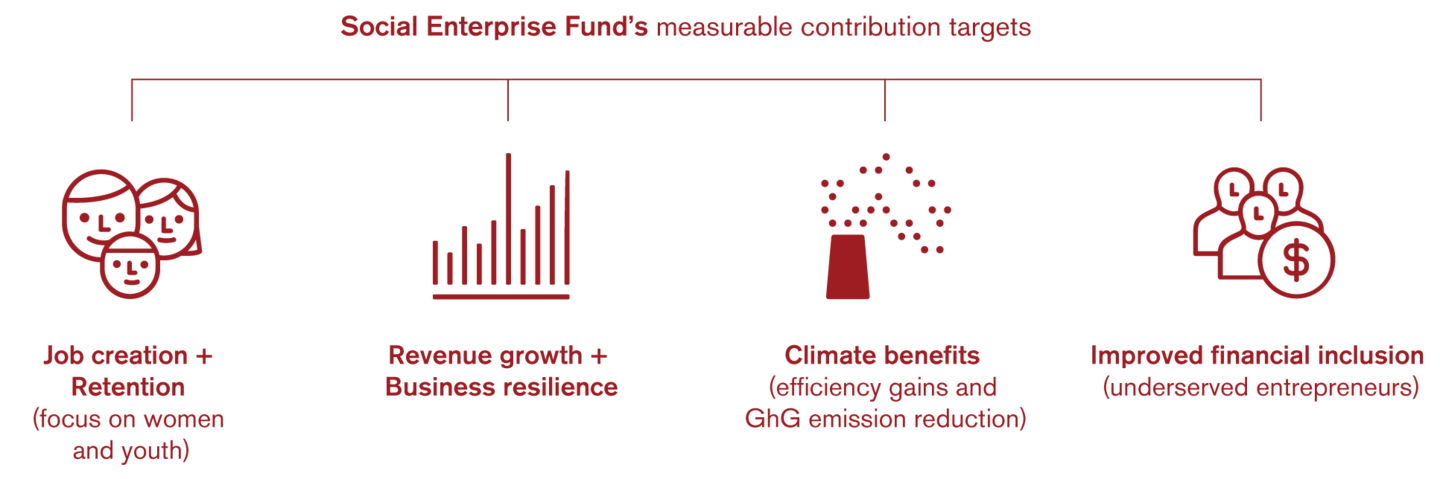

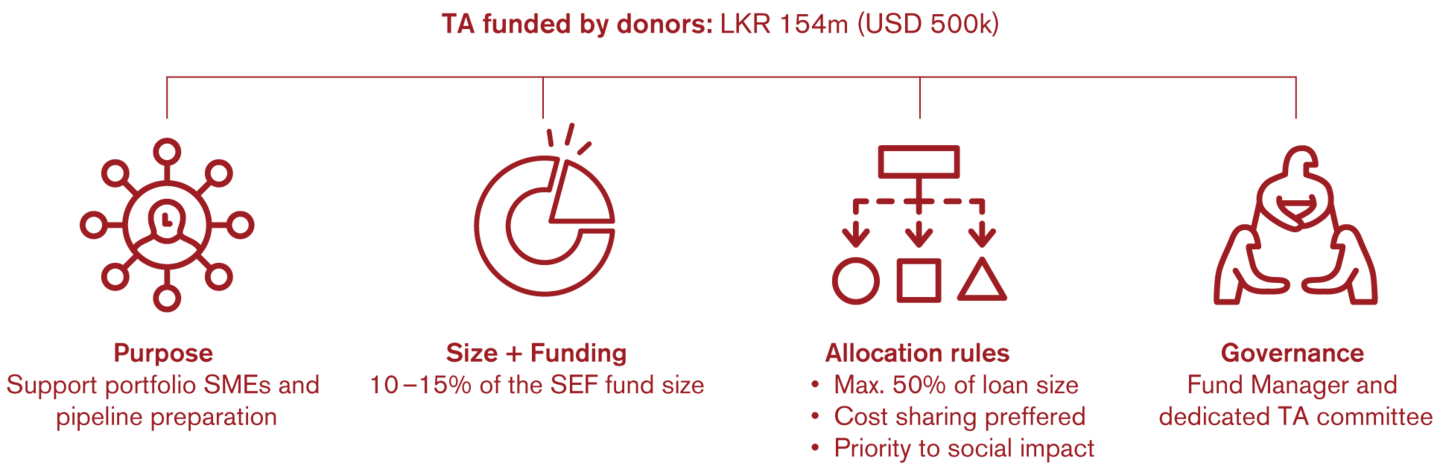

By combining long-term market-based capital and a dedicated Technical Assistance Facility, the fund enables social enterprises to scale sustainably while delivering measurable social, economic and environmental impact.

Investee profiles

The Social Enterprise Fund is applicable across all sectors and focuses on SMEs at the acceleration stage that demonstrate strong business fundamentals and scalable models, delivering measurable social impact and gender-inclusive outcomes across priority areas. These include climate-smart agriculture, circular economy, waste solutions, and clean and renewable energy.

Operational setup

Strategic partners

Helvetas has been active in Sri Lanka since 1978. Its work has focused on strengthening the economic rights and livelihoods of disadvantaged groups while building long-standing, trusted partnerships with public institutions, civil society and private-sector actors across the South, East, and North of the country. Helvetas supports the Social Enterprise Fund through a catalytic investment in the first loss class.

United Nations Development Program serves as the impact monitoring partner to the Social Enterprise Fund, leveraging its expertise in results-based management to strengthen national monitoring and evaluation systems, support sector programs in establishing robust results frameworks, and building data and reporting capacities to track outcomes and meet international reporting standards.

Fund manager

The Lanka Impact Investing Network operates as Sri Lanka’s first dedicated impact investment firm, supporting the growth of the country’s social enterprise ecosystem by combining investment capital with targeted business development support. Positioned between microfinance and traditional private equity, the Lanka Impact Investing Network focuses on SMEs with scalable business models that address social and environmental challenges.

Impact

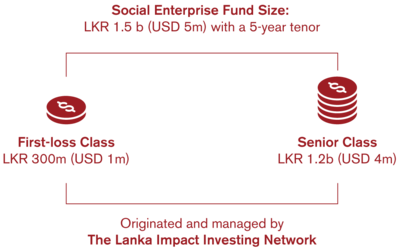

Key financials

Technical assistance facility

Partner with us

Together, we will secure YouLeap’s legacy by enabling Sri Lankan social enterprises to ensure long-term sustainability for Helvetas’ partner enterprises and the broader ecosystem. To support this transition, we are seeking partners to capitalize the Social Enterprise Fund and its technical assistance facility.

Partner with us to mobilize long-term, market-based capital for inclusive growth and measurable impact. Together, we will enable SMEs to create jobs, strengthen livelihoods, advance women's economic empowerment and build climate resilience across Sri Lanka.