In the architecture of local governance, revenue is power. When municipalities can raise and manage their own resources, they are not only more responsive—they are more resilient. But for many local governments, especially in transitioning or centralized systems, own-source revenue remains more aspiration than reality. In Serbia, 145 municipalities strive to provide essential public services but often struggle to generate adequate revenue due to limited administrative capacity, outdated property and business registries and a largely informal economy. Recognizing the potential of property tax to enhance fiscal decentralization, Serbia has taken steps towards improving local administration, aiming to unlock the financial resources needed to empower these municipalities and better serve their communities.

Immovable, visible, and deeply tied to place, property tax offers a unique opportunity to bridge public finance and public trust. Yet for decades, it remained one of Serbia’s most underleveraged tools. That is now changing. Over the past decade, a quiet transformation has taken place in Serbia. Once hampered by outdated systems and low trust, local governments are now using property tax to collect revenue and build stronger, more responsive communities. With the support of Helvetas and the Swiss Agency for Development and Cooperation, the Municipal Economic Development (MED) Program has helped turn property tax into a practical tool for local development—and a model for others navigating the complex path of fiscal decentralization.

The Road to Fiscal Autonomy: Serbia’s Ongoing Challenge

Over the past two decades, fiscal decentralization has been advocated in Serbia to empower local governments and improve the quality and responsiveness of public services. The 2006 Law on Local Self-Government Finance was a turning point, granting municipalities increased autonomy over their financial affairs. In theory, this legal framework aimed to shift both responsibility and authority to the local level.

In practice, however, decentralization in Serbia has been uneven and underfunded. While local governments are formally responsible for a growing range of services, they remain heavily dependent on central government transfers, which accounted for over 78% of municipal revenues in 2020. Their capacity to raise and manage own-source revenues—the most critical component of financial autonomy—remains limited.

Within this constrained landscape, property tax has emerged as the most reliable and scalable local revenue stream. Its characteristics make it uniquely suited to local governance: the tax base is immovable, visible, and directly tied to the services funded by local budgets. Yet despite its potential, property tax was historically underutilized due to outdated cadastral records, fragmented databases, low administrative capacity, and weak citizen trust in public institutions.

The 2013 amendments to Serbia’s Property Tax Law introduced a pivotal reform: transitioning to market-based valuation, consolidating fees into the tax base, and reducing exemptions. But implementation was uneven. The question was no longer what to reform, but how to build lasting, equitable, and trusted systems around property tax. That is where the program stepped in.

Program Approach to success: Systems, Trust, and Local Ownership

Recognizing both the challenges and untapped potential of property tax, with support from the Swiss Agency for Development and Cooperation (SDC), the program launched a series of initiatives through the Accountable Local Finance and Citizen Participation program. Starting in 2013 as a pilot in nine municipalities, the effort has since scaled to all 145 local self-governments across Serbia.

The program approach was holistic, iterative, and grounded in local realities. Rather than imposing a top-down model, the program began with detailed needs assessments and worked alongside local tax administrations to modernize systems, upgrade skills, and improve taxpayer engagement.

A major breakthrough was the development and rollout of the Unified Information System (UIS) for property tax administration. Before UIS, municipalities used fragmented software solutions that could not communicate with each other—or with central institutions like the cadastre or the Ministry of Interior. UIS changed that by centralizing taxpayer data, enabling cross-agency data exchange, and introducing online services, making tax payment and compliance more accessible and user-friendly.

But digital transformation was only one pillar. The program also prioritized political ownership and civic engagement. Mayors were supported in publicly championing the reforms, local tax officials received continuous training and mentoring, and communication campaigns helped shift public perception from tax as a burden to tax as a community investment.

“The program’s support has significantly improved the work of Local Tax Administrators (LTA), particularly in terms of tax collection. It has also connected LTA employees from all participating cities, which is of particular importance for our future work.” says Biserka Jovicevic, head of Local Tax Administration, City of Sombor.

Helvetas served as an advocate for municipalities at the national level, facilitating feedback loops between local tax offices and ministries, and helping to refine legal frameworks through field-informed policy proposals. This vertical collaboration was key in ensuring that local voices were heard in national reform discussions—an often-missing link in decentralization processes.

High returns and lasting impact

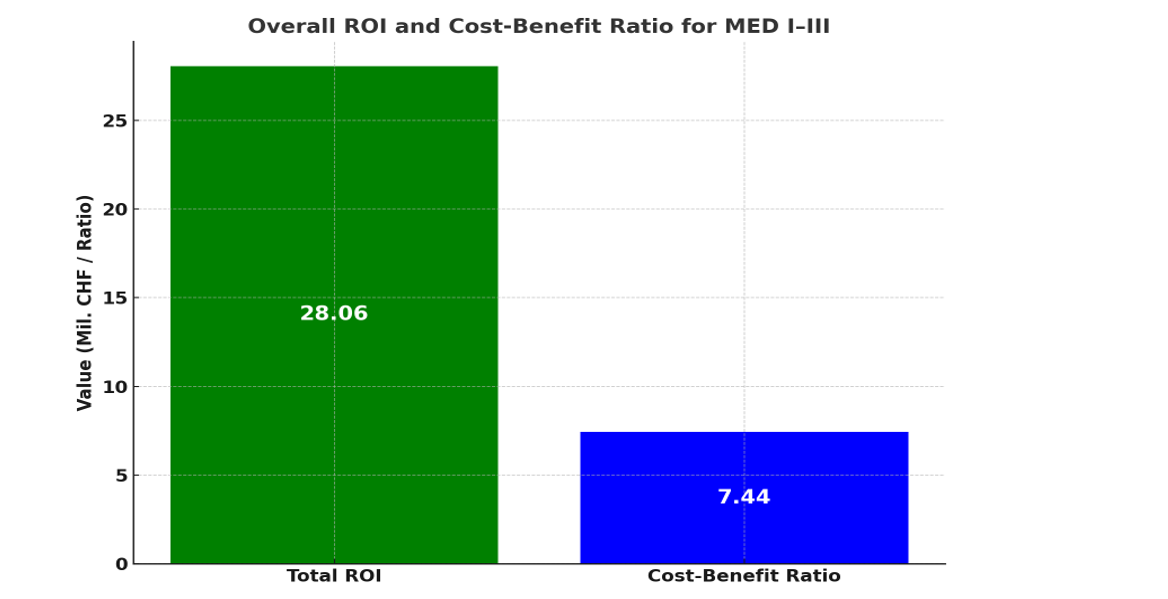

As shown in the graph below, the MED program has proven to be a financial game-changer, showcasing a remarkable Return On Investment (ROI) of 28.06 million CHF from an initial investment of just 4.36 million CHF. The Cost-Benefit Ratio of 7.44 is nothing short of extraordinary, indicating that each Swiss franc invested in the program has yielded over seven Swiss francs in return. This speaks volumes about the program's operational efficiency, suggesting that its blend of technical assistance, incentives, and operational support was crafted not only with vision but executed with precision.

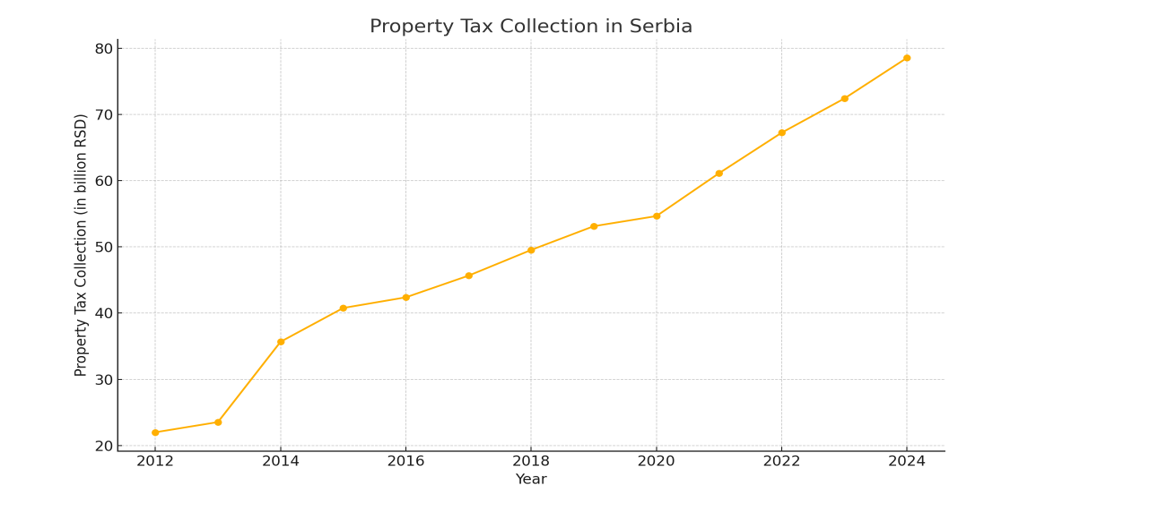

Looking ahead, the sustainability analysis of property tax revenue in Serbia from 2012 to 2024 weaves a compelling narrative of growth and stability. A groundbreaking leap in 2014 saw a striking 51.5% surge in revenue, a response to transformative legal reforms and enhanced tax frameworks. Since then, growth has settled into a vibrant rhythm, oscillating between 3% and 12% annually, heralding a shift away from the tumultuous boom-bust cycles of the past. Property tax has firmly established itself as a dependable and essential revenue source for municipalities, pivotal for advancing fiscal decentralization and fortifying local governance in Serbia.

What we can learn from Serbia’s Experience

Serbia’s journey shows that property tax reform is not simply a technical upgrade—it is a long-term governance transformation. Here are some key lessons:

Property tax is about more than revenue. When designed and communicated well, it becomes a tool for accountability, citizen engagement, and trust-building. Citizens are more willing to pay when they see how their money is used—and when public services improve in visible ways. The decision to raise, reform, or enforce property tax isn’t just administrative—it’s a political calculation. Any reform must consider local dynamics, leadership incentives, and citizen perceptions.

Technology enables, but people drive change. Local capacity must be built systemically. Investing in IT systems without supporting training, communication, legal reform, and organizational change leads to uneven results. Helvetas’ experience demonstrates the value of patient, adaptive programming that addresses both the technical and human sides of reform.

Fiscal decentralization only works when local governments have real control over their revenue streams. Strengthening own-source revenues—especially through property tax—is essential to ensure that municipalities can meet their mandates, respond to local priorities, and deliver services with predictability and autonomy.

Civic engagement is a prerequisite not a bonus. Citizens are more inclined to pay taxes when they grasp the connection between taxes and the services provided. Effective communication, transparency, and active participation are essential for sustainable tax reforms.

One-size-fits-all doesn’t work. Municipalities differ in size, economic capacity, political will, and public expectations. Reform needs flexibility, adaptability, and ongoing tailormade support. The program approach allowed municipalities to move at their own pace while still aligning with national reform goals.

Meaningful impact was met through the MED program: In 2024, Serbian municipalities saw an increase of €52 million in property tax revenue. But beyond numbers, what matters is that citizens are seeing change, and local governments are delivering it.